In the rapidly evolving world of technology, banks are positioned to play a crucial role in meeting the growing needs of the metaverse. Metaverse is a digital universe blending augmented and virtual realities. Metaverse can influence banking by being the providers of digital identification and currency, banks have an opportunity to leverage AR/VR and other technologies to reshape customer interactions and navigate the expanding metaverse economy.

Metaverse‘s Globalized and Emotional Banking

With banking becoming increasingly globalized and less emotionally resonant, the metaverse offers a unique chance for banks to provide guidance. This foster relationships in a more immersive environment. The metaverse has the potential to reintroduce in-person engagements in ways that transcend text messages or app alerts, with 47% of bankers foreseeing a shift to AR or VR transactions by 2030.

Advantages of Metaverse Banking

Metaverse banking offers several advantages, from reinventing transactions for a 3D world to engaging employees in innovative ways. Banks can attract young talent, provide more human interactions online, and find novel ways to interact with customers.

Redefining Customer and Employee Interactions

Banks can utilize AR and VR technologies to create 3D experiences for both customers and staff. Metaverse banking enables customers to review balances, transfer money, pay bills, and conduct business through immersive channels. For employees, it provides opportunities for immersive learning in secure, replicated settings. This facilitates the integration of remote workers in ways that foster enjoyment and connection.

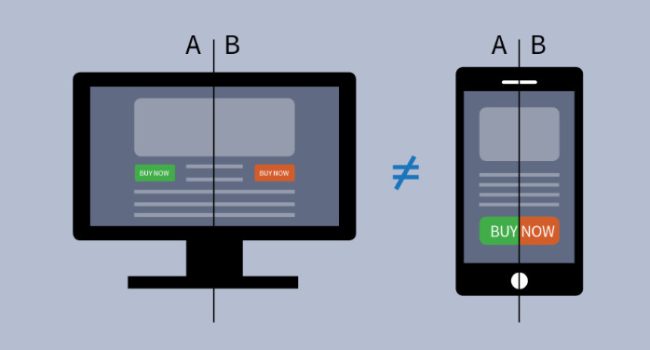

Innovative Customer Interaction Methods

Metaverse banking allows banks to rethink customer interactions by offering personalized guidance, sympathetic support, and trust. Customers could engage with avatars remotely or visit physical locations providing metaverse experiences. This creates a more personalized and vivid banking experience.

Metaverse’s Impact on the Dynamic Between Banks and Clients

By utilizing the metaverse to connect entities from both virtual and physical worlds, banks can encourage a sense of community and cooperative involvement among their customers. Remote and virtual interactions may feel more intimate and human, enhancing the online banking experience.

Why Banks Should Care About NFTs

Non-fungible tokens (NFTs) present a unique opportunity for banks to secure, loan against, and ensure digital assets. With NFTs representing ownership of digital items, banks can explore this innovative space to enhance their services and offerings.

Challenges and Risks in the Metaverse

Despite the exciting possibilities, banks and other brands may face reputational and legal challenges in the metaverse. Several unforeseen issues encounters on social media platforms. Therefore, navigating the metaverse requires careful consideration of data ownership, diversity and inclusion, risk management, sustainability, security, and personal safety.

Preparing for Regulatory Oversight

As the metaverse blurs the line between real and digital lives, banks should anticipate increased scrutiny from regulators and consumers regarding privacy, bias, justice, and human impacts. Proactive measures, from data ownership to diversity and inclusion initiatives, will be essential for responsible metaverse development.

Starting the Exploration Journey

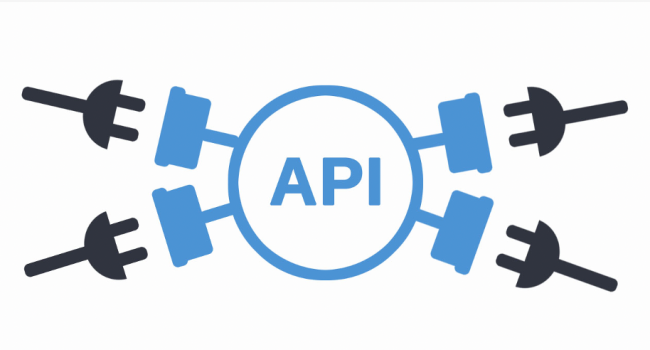

While the metaverse is still in its early stages, banks can prepare for its trajectory by examining the market and technological landscape. Understanding changes, identifying potential partners, and assessing technological readiness are crucial steps. Investments in mature clouds, distributed ledgers, virtual marketplaces, and AR/VR can position banks to adapt to the upcoming changes.

XR Studios and Metaverse

In the cool world of virtual and augmented reality, XR Studios is doing something amazing. They’re like pioneers creating a special digital space called the metaverse, and it’s going to have some really cool uses. This super creative studio is using Extended Reality (XR) tech to make awesome digital experiences.

Imagine playing games or learning things in a totally different way. Well, that’s what XR Studios is working on. They’re not just making things look cool; they’re figuring out how to use this tech for useful stuff too.

As XR Studios keeps exploring, we can expect lots of new and exciting things. They’re like the architects of a digital future that’s going to change how we do things online. Get ready for some really fun and different digital adventures thanks to XR Studios!

Conclusion

In conclusion, the metaverse presents a transformative opportunity for banks to redefine their role in the digital age. By embracing AR/VR technologies, personalized interactions, and innovative experiences, banks can navigate the digital frontier and offer enhanced services to both customers and employees. As the metaverse continues to develop, banks should be proactive in exploring potential applications and preparing for the exciting changes that lie ahead.